Investment incentives

Investment incentives

The promotion of investment is one of the key foci of Armenian economic policy. The key objectives are to provide incentives to foreign investors with the goals of increasing the country’s exports and stimulating employment, creating a favorable investment and business environment, increasing the transparency of the regulatory framework, and ensuring sustainable economic growth in Armenia. Armenia has declared an “open door” investment policy, which is defned in the law “On Foreign Investments” and in the Investment Policy of Armenia. The Republic of Armenia has one of the most open investment regimes among emerging market countries.

The law “On Foreign Investments” protects foreign investors against nationalization or expropriation of property, except in extreme cases of natural or state emergency, determined in accordance with a judicial decision, and with full and mandatory compensation. The Armenian constitution goes as far as to require that the compensation for expropriated property be paid in advance, before the property is taken from the owner. Foreign investors are also entitled to compensation for damages and losses (including lost proft) resulting from unlawful acts of State authorities or State offcials or improper performance of their duties.

The law “On Foreign Investments” provides guarantees for national treatment and non-discrimination for foreign investors. The laws applied to foreign investments cannot be less favorable than the laws governing the property rights and investment activities of citizens and legal entities of Armenia. There are no restrictions on the participation of foreign investors in any economic activity in Armenia or on the percentage of ownership of a local business that foreign investors can acquire. The only exception is that foreign citizens and persons without citizenship have no right to own land in Armenia. However, foreigners are allowed to use land through long-term lease contracts. Furthermore, foreigners have the right to own structures built on Armenian land, and to exploit renewable and non-renewable natural resources through concession contracts granted by the Government.

The law “On Foreign Investments” contains a “grandfathering” clause. In case of any change in the legislation on foreign investment, the law in force at the time the investment was made can, upon the request of a foreign investor, continue to be applied for a maximum of fve years from the date of the investment.The law also stipulates that investment–related disputes in which the State is a party shall be settled in Armenian courts. All other disputes to which the State is not a party can be considered by the Armenian courts or any other bodies resolving economic disputes or, upon the agreement of the parties, in arbitration tribunals. Armenia is a signatory to the International Convention on Investment Disputes, which allows dispute resolution by the International Centre for the Settlement of Investment Disputes (ICSID).

Under current legislation there are no restrictions on the conversion and transfer of money or the repatriation of capital, earnings, dividends, interest, royalties, or management or technical service fees. Foreign investors and employees are guaranteed the right to freely repatriate their property, profts or other assets that result from their investment after payment of all due taxes.

Armenia has a liberal exchange system, and in general, there are no restrictions on converting or transferring funds associated with an investment into freely usable currency, and at a legal, market-clearing rate. Foreign exchange is widely available, and the local currency, the Armenian dram (AMD), is freely convertible. Maintaining foreign currency accounts in Armenia is also permitted.

Surveys suggest that Armenia is a relatively easy country in which to do business. The World Bank study, Doing Business 2012, ranked Armenia as the 55th (compared to 61st in 2011) easiest country to do business out of 183 countries surveyed.

Armenia’s cumulative rating according to the Heritage Foundation “Index of Economic Freedom” is 68.8, “Moderately Free”, making its economy the 39th freest economy in the 2012 index. Armenia is ranked 19th freest among the 43 countries in Europe, and its score puts it above the world average.

According to the United Nations Development Programme’s annual report on “Human Potential Development Index” for 2011, Armenia is classifed among countries with a “high level” of human development potential.

Investment incentives

Foreign investors can beneft from the following investment incentives:

1. Ownership: 100% ownership permitted.

2. Admission: There is no screening and no specifc authorization required for making an investment.

3. Land ownership: Companies registered by a foreigner in Armenia have the right to buy land. Although foreign citizens are not allowed to own land in Armenia, they are offered long-term lease contracts.

4. Import: For investment projects, VAT payments for imported goods exceeding 300 million AMD are deferred for three years.

5. Export duties and restrictions: None.

6. Export VAT. Zero rating in Armenia applies to goods and services exported under “Free Turnover” and “Re-exportation” customs regimes.

7. Investment guarantees. In case of any changes in legislation foreign investors can choose which law to use for up to a fve-year term (fve-year grandfather clause)

8. Free Economic Zones. Companies operating in free economic zones are fully relieved from income tax, property tax, proft tax, and custom duties, as well as VAT for services delivered to the organizer and operator and products in the territory of the free economic zone. In determining the taxable income of a taxpayer who is a free economic zone operator for a full year, aggregate income is reduced by the amount of income received from activities conducted in the free economic zone.

9. Exchange Control. Free exchange of foreign currencies.

10. Remittance. No restrictions on remittances.

11. Proft. Free repatriation of proft.

12. Staff Recruitment. No restrictions.

13. Location. No sector-specifc or geographic restrictions on investments.In addition to the specifc investment incentives described above, the following factors make Armenia attractive for Foreign Direct Investment:

A. Stable macroeconomic situation

Armenia has a prudent macroeconomic policy framework in place and is characterized by a stable overall macroeconomic environment, as recognized by major international organizations. Economic legislation and regulations comply with international standards and WTO requirements.

B. Sustainable banking system in line with international standards

Armenia’s banking system operates in accordance with core Basel II standards. Free operation of foreign currency accounts is available. No restrictions on remittances exist. The organizer of the stock market is NASDAQ OMX Armenia OJSC, which is part of the NASDAQ OMX Group, Inc. international group. NASDAQ OMX Armenia is a member of the Federation of Euro-Asian Stock Exchanges (FEAS) and the International Association of Exchanges of the Commonwealth of Independent States (IAEx of CIS).

C. High experienced, creative, cost efficient and well educated workforces

The quality of Armenia’s highly trained and skilled workforce is widely recognized by established foreign investors. The local workforce is relatively inexpensive and provides a clear comparative and competitive advantage for Armenia.

D. Armenian diaspora

Armenia has a very sizeable Diaspora living abroad of about 6 million – primarily in the Middle East, the United States, the Russian Federation and Western Europe – which forms a vibrant potential pool of investors looking for opportunities to invest capital in their home country.

E. Hospitality and safety

Armenia is a country with a strong tradition of hospitality and is a very safe country to visit and travel in.

Foreign direct investment and Free Economic Zones

Foreign direct investment

Armenia, a country that largely depends on foreign trade, is making signifcant efforts to attract foreign direct investment. The Government has adopted an “open door” policy, with Most Favored Nation (MFN) and National Treatment regimes in place, and thorough-going legal protection to promote foreign investment. The law “On Foreign Investments” ensures a highly favorable business environment for foreign investors. It also allows unlimited participation of foreign capital in Armenian enterprises and ensures its protection.

Armenia, a country that largely depends on foreign trade, is making signifcant efforts to attract foreign direct investment. The Government has adopted an “open door” policy, with Most Favored Nation (MFN) and National Treatment regimes in place, and thorough-going legal protection to promote foreign investment. The law “On Foreign Investments” ensures a highly favorable business environment for foreign investors. It also allows unlimited participation of foreign capital in Armenian enterprises and ensures its protection.

Foreign investors are entitled to implement investments through:

- Establishment of a fully foreign-owned company (including representatives, affliates and branches), or the purchase of an existing company;

- Establishment of a new joint venture company with the participation of Armenian companies or citizens, or the purchase of shares in an existing company;

- Purchase of different types of securities;

- Procurement of permits to use the land, or a concession agreement for the use of Armenian natural resources with participation of Armenian companies or citizens; or

- Procurement of other property rights. According to the National Statistical Service of Armenia, foreign direct investment in Armenia rocketed from $70 million USD in 2001 to $1 billion USD in 2008. Although a decline in investments was observed immediately subsequent to the international fnancial crisis in 2009-2010, the infow of foreign investments in 2011 increased to $816m USD, of which $631m USD represented foreign direct investments.

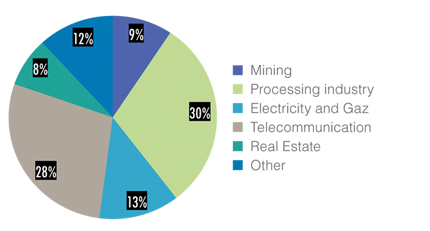

FIGURE 9. FOREIGN DIRECT INVESTMENT BY SECTORS (AS OF THE END OF 2011)

Major sources of investment in the Armenian economy include the Russian Federation ($3,170 million USD), followed by France ($727 million USD), Greece ($479 million USD), United States ($378 million USD), Lebanon ($365 million USD), Germany ($357 million USD) and Argentina ($334 million USD). Russia, France and the United States were the three biggest investors in Armenia in 2011. The three most important sectors where foreign investments were directed in 2011 included the processing industry ($246 million USD), telecommunications ($231 million USD), and electricity and gas ($101 million USD). The information technology sector has major investment potential as well.

Free Economic Zones

Free economic zones (FEZs) in Armenia offer a unique opportunity for entrepreneurs to establish businesses in strategic sectors of the economy and to process, produce and export goods with a reduced tax burden. FEZs allow the export of goods without any restrictions to international markets with more than 500 million consumers. The law “On Free Economic Zones” and tax legislation grant exemptions from proft tax, income tax, property taxes, VAT and customs duty payment obligations to companies operating within FEZs.

The law on FEZs grants the following incentives to FEZ operators and organizers:

- NO VAT for delivering services and supplying goods in FEZ territory;

- Tax-free proft to legal entities and NO income tax for sole proprietor acting as operators or organizers of FEZs;

- NO property taxes on public and industrial buildings and structures owned or leased within FEZs;

- NO customs charges and non-tariff regulation measures applied to the export of goods released under the customs regime “Imports into Free Economic Zones”, or to other goods produced due to the use of such goods within the territory of FEZs;

- Freely convertible currency is ALLOWED as a medium of exchange while trading within FEZs, unlike the entire territory of the Republic of Armenia, where trade is allowed only through use of the national currency.

The services rendered by the State bodies in FEZs are implemented on a simplifed, “one stop shop” basis.

Two FEZs will soon be operational in Armenia. One of them will be in the agricultural sector, in the area adjacent to “Zvartnots” International Airport. This FEZ will focus on the storage, grading, deep freezing and packaging of fresh fruit and vegetables. The second FEZ, which is established in the territory of RAO Mars Closed Joint-Stock Company and Yerevan Research Institute of Mathematical Machines, will specialize in the production and export of innovative technologies in the areas of electronics, precision engineering, pharmaceuticals and biotechnology, information technologies, alternative energy, industrial design and telecommunication (design and production of technological equipment, systems and materials for data/information transfer).

Multilateral and bilateral treaties

Multilateral and bilateral treaties

Armenia is a growing market offering promi- sing business opportunities to traders and investors. Trade agreements signed by Armenia which promote and protect recipro-cal investments are among the key attractions of the business and investment environment.

Table 4. The list of countries having bilateral investment treaties for the promotion and protection of foreign investments with Armenia (as of 15.02.2012)

| N | Country | Signed | Validated | Entered into force |

|---|---|---|---|---|

| 1 | Argentina | 16.04.1993 | 27.09.1993 | 10.10.1994 |

| 2 | Austria | 17.10.2001 | 09.10.2002 | 01.02.2003 |

| 3 | USA | 23.09.1992 | 26.09.1995 | 29.03.1996 |

| 4 | Bulgaria | 10.04.1995 | 29.08.1995 | 27.03.1996 |

| 5 | Belgium-Luxemburg | 07.06.2001 | 20.02.2002 | 19.12.2003 |

| 6 | Germany | 21.12.1995 | 23.06.1997 | 04.08.2000 |

| 7 | Iran | 06.05.1995 | 14.11.1995 | 26.02.1997 |

| 8 | Lebanon | 01.05.1995 | 29.08.1995 | 01.10.1998 |

| 9 | Canada | 08.05.1997 | 17.03.1999 | 29.03.1999 |

| 10 | Cyprus | 18.01.1995 | 12.06.1996 | 03.08.1998 |

| 11 | India | 23.05.2003 | 27.04.2004 | 30.05.2006 |

| 12 | Greece | 25.05.1993 | 13.10.1993 | 28.04.1995 |

| 13 | Kyrgyzstan | 04.07.1994 | 29.08.1995 | 26.11.1995 |

| 14 | United Kingdom of Great Britain and Northern Ireland | 27.05.1993 | 13.10.1993 | 11.07.1996 |

| 15 | China | 04.07.1992 | 06.10.1992 | 17.03.1993 |

| 16 | Romania | 20.09.1994 | 11.10.1995 | 24.12.1995 |

| 17 | Vietnamm | 01.02.1993 | 28.04.1993 | |

| 18 | Georgia | 04.06.1996 | 18.02.1997 | 18.01.1999 |

| 19 | Ukraine | 07.10.1994 | 16.01.1996 | 07.03.1996 |

| 20 | France | 04.11.1995 | 05.08.1996 | 21.06.1997 |

| 21 | Italy | 23.07.1998 | 11.10.2000 | 12.12.2000 |

| 22 | Switzerland | 19.11.1998 | 09.10.2002 | 04.11.2002 |

| 23 | Israel | 19.01.2000 | 21.03.2001 | 25.06.2003 |

| 24 | Qatar | 22.04.2002 | 23.10.2002 | 08.10.2007 |

| 25 | Tajikistan | 03.04.2002 | 04.11.2002 | 18.11.2002 |

| 26 | Russian Federation | 15.09.2001 | 02.12.2005 | 08.02.2006 |

| 27 | Belarus | 26.05.2001 | 21.11.2001 | 10.02.2002 |

| 28 | UAE | 20.04.2002 | 04.11.2002 | 27.04.2009 is sent to UAE |

| 29 | Uruguay | 06.05.2002 | 25.03.2003 | Hasn’t been validated by Uruguay yet |

| 30 | Finland | 05.10.2004 | 27.02.2007 | 20.04.2007 |

| 31 | Turkmenistan | 19/03/1996 | - | |

| 32 | Egypt | 09/06/1996 | 08.12.2005 | 21.02.2006 |

| 33 | Netherlands | 10.06.2005 | 02.12.2005 | 01.08.2006 |

| 34 | Latvia | 07.10.2005 | 27.02.2007 | 21.04.2007 |

| 35 | Sweden | 08.02.2006 | 25.02.2008 | 01.05.2008 |

| 36 | Litva | 25.04.2006 | 27.02.2007 | 16.03.2007 |

| 37 | Kazakhstan | 06.11.2006 | 25.02.2008 | 01.08.2010 |

| 38 | Syria | 17.06.2009 | 16.11.2009 | 26.04.2010 |

| 39 | Kuwait | 25.06.2010 | - |

Armenia has signed bilateral treaties on reciprocal promotion and protection of investments with 39 countries (see table 4), and is currently negotiating more such treaties with an additional 24 countries. Armenia is also a signatory of the International Convention on Investment Disputes. In addition, it has double taxation treaties with 35 countries as of 2012 (see table 5). The benefts of these particular treaties are easy to access by providing supporting documentation of residency from foreign tax authorities.

Table 5. The list of countries having Double taxation treaties with Armenia and the summary of withholding rates under the various treaties

| Armenia Treaty Partner | Dividends (%) | Interest (1) (%) | Royalties (%) | |

|---|---|---|---|---|

| Country | Non-Portfolio | Portfolio | ||

| Non-treaty | 10 | 10 | 10 | 10 |

| Austria | 5 (2) | 10 | (3) | 5 |

| Belarus | 10 (4) | 10 | 10 | 10 |

| Belgium | 5 (2) | 10 | (3) | 8 |

| Bulgaria | 5 (5) | 10 | 10 | 10 |

| Canada | 5 (6) | 10 | 10 | 10 |

| China (P.R.C.) | 5 (7) | 10 | 10 | 10 |

| Croatia | 0 (8) | 10 | 10 | 5 |

| Cyprus | 0/5 (9) | 10 | 5 | 5 |

| Czech Republic | 10 | 10 | (10) | (11) |

| Estonia | 5 (7) | 10 | 10 | 10 |

| Finland | 5 (7) | 10 | 5 | 5/10 (12) |

| France | 5 (2) | 10 | (13) | (14) |

| Georgia | 5 (7) | 10 | 10 | 5 |

| Greece | 10 | 10 | 10 | 5 |

| Hungary | 5/7 (7) | 10 | 0/5/10 (10) | 5 |

| India | 10 | 10 | 10 | 10 |

| Iran | 10 (7) | 10 | 10 | 5 |

| Italy | 5 (15) | 10 | 0/10 (16) | 7 |

| Kazakhstan | 10 | 10 | 10 | 10 |

| Latvia | 5 (7) | 10 | 10 | 10 |

| Lebanon | 5 (7) | 10 | 8 | 5 |

| Lithuania | 5 (7) | 10 | 10 | 10 |

| Luxembourg | 5 (2) | 10 | 10 (16) | 5 |

| Moldova | 5 (7) | 10 | 10 | 10 |

| Netherlands | 0/5 (17) | 10 | 0/5 (13) | 5 |

| Poland | 10 | 10 | 5 | 10 |

| Qatar | 5 (18) | 10 | 5 | 5 |

| Romania | 5 (7) | 10 | 10 | 10 |

| Russia | 5 (5) | 10 | 0 | 0 |

| Switzerland | 5 (19) | 10 | 0/10 (3) | 5 |

| Syria | 10 | 10 | 10 | 12 |

| Thailand | 10 | 10 | 10 | 10 |

| Turkmenistan | 5 (7) | 10 | 10 | 10 |

| Ukraine | 5 (7) | 10 | 10 | 0 |

| United Arab Emirates | 3 | 3 | 0 | 5 |

The treaty generally applies automatically when a local company holds an appropriate residency certifcate issued by foreign tax authorities.Armenia is actively involved in the regional trade integration process. The country has signed free-trade agreements with Georgia and most of the CIS countries, including Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russian Federation, Tajikistan, Turkmenistan and Ukraine. Armenia is a signatory to the CIS Multilateral Convention on the Protection of Investor Rights and the CIS free trade zone agreement, which is designed to reduce all trade fees on a number of goods between the countries involved.Armenia has full membership status in the World Trade Organization (WTO). Armenia is also a member of a number of international organizations including IMF, WHO, World Bank, IDA, UNECE, EBRD, BSEC, WCO, UN, UNCTAD, UNESCO, IFAD, UNIDO, ILO, WIPO, INTERPOL, ITU, IAEA, ISO and others. Currently Armenia is actively involved in negotiations with the EU on an Association Agreement which will include the establishment of a Deep and Comprehensive Free Trade Area (DCFTA).

Import and Export Regime

Import and Export Regime

Armenia’s foreign trade policy aims to attract foreign direct investments and liberalize trade regimes. As a member of the World Trade Organization since 2003, Armenia has worked to reduce customs burdens and reform the existing customs system. Examples include an on-line customs declaration system (e-declaration); a traffc light system for inspection of goods entering Armenia; and a reduction in the number of import documents from nine to three. Today Armenia offers a liberal trade and investment regime. The average applied tariff, at 2.7%, is among the lowest of WTO Members. As the WTO member Armenia benefts from Most Favored Nation (MFN) treatment and has an MFN regime in place with all WTO member countries. In its turn it grants MFN and National Treatment regimes to foreign investors, which are present in almost every economic sector.Armenia’s customs policy is administered by the State Revenue Committee. Customs regimes and procedures are defned by the Customs Code of the Republic of Armenia and other legal acts, which comply with rules defed by WTO agreements and other international treaties.Armenia is a member of the World Customs Organization (WCO) and applies the Harmonized System for tariff classifcation, in compliance with the 1984 International Convention on Harmonized Commodity Description and Coding System. Only two tariff rates apply on imports of goods to Armenia: 0% or 10%. The 0% tariff applies to imports of capital goods, and the 10% tariff to imports of consumer products. All imports are subject to the payment of a VAT of 20% and alcoholic beverages, tobacco products, and fuels are also subject to an excise tax.There are no tariff quotas, licensing requirements or quantitative restrictions on imports. Nor does Armenia maintain a system of minimum import prices.Armenia does not tax exports and does not have any licensing requirements for exporting. There are neither export duties nor VAT payment obligations or limitations.The volume of foreign trade in Armenia in 2011 was 2,044.2 billion AMD or $5,481.0 million USD, of which exports were 495.8 billion AMD or $1,329.5 million USD, and imports were 1,548.4 billion AMD or $4,151.5 million USD (See table 3 and fgure 10).

IMPORT REGLATIONS

Armenian legislation requires all goods and vehicles imported through the border of Armenia to be subject to declaration in the Regional Customs House where the importing organization or sole proprietor operates, with the exception of Yerevan Zvartnots Customs House, TIR Customs House and the Automobile Customs Point.

There are nine customs houses (fve regional and four specialized) and six customs points. Seven of these work around-the-clock:

- Zvartnots customs-house,

- Meghri customs point,

- Bavra customs point,

- Shirak airport customs-house,

- Bagratashen customs point,

- Ajrum-Jilizia customs point, and

- Gogavan-Privolnoye customs point.

Customs clearance is not obligatory at the border, but may be carried out by the importer or by a licensed customs broker.

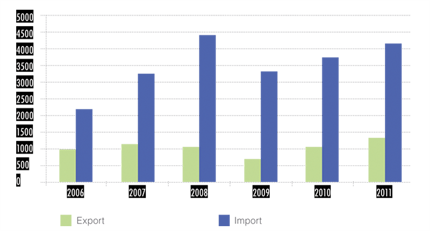

Table 3. The volume of export and import to Armenia per year (million USD)

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

|---|---|---|---|---|---|---|

| Export | 985,1 | 1152,3 | 1057,2 | 710,2 | 1041,1 | 1329,5 |

| Import | 2191,6 | 3267,8 | 4426,1 | 3321,1 | 3748,9 | 4151,5 |

Source: NSS

Figure 10. Export and Import of Armenia per year

All goods imported commercially must be declared to customs within ten days after arrival in the Armenian customs territory, and they remain under customs control during this period (although not necessarily under physical control). Though not yet compulsory, the on-line customs declaration system (e-declaration) will replace many functions previously done on paper, such as management of custom cards and production of customs declarations. This greatly reduces the time required for completion of customs procedures. The electronic card system combines a number of functions related to customs payments, so any necessary procedures can be carried out from an offce computer. The release of customs declarations for which payment was made electronically is sent through TWM system. The upgraded electronic system includes a traffc light (channel) system at the border. Goods passing through the green channel cross the border without any verifcation. If the red channel is selected, the import is subject to documentary verifcation and physical examination. For the yellow channel, only documentary verifcation is necessary.According to studies by the World Bank, it took on average only two days to complete the customs clearance procedure in 2011. Only three documents needed be presented at customs clearance.After the reforms were implemented, the Customs Code introduced post-clearance controls, through which the State Revenue Committee may review customs declarations submitted during the last three years.While most imports are free of prohibitions, quotas or licensing requirements, there are restrictions for health, security or environmental reasons. These restrictions include requiring authorization for pharmaceutical products and medicines, phytoprotection chemicals, weapons, components used in the production of weapons, explosives, nuclear materials, poison, drugs, strong psychotropic substances, devices for use in opium smoking, and pornographic materials. The transit through Armenian territory of any nuclear material, nuclear-related equipment or substances emitting ionizing radiation is prohibited.The import of medicines must be authorized by the Ministry of Health, and the import of agricultural chemicals by the Ministry of Agriculture.There are compulsory health, hygiene, and consumer rights standards for a range of foodstuffs, electrical goods, alcoholic and non-alcoholic beverages, tobacco products, and children’s clothes, among other imports.The Republic of Armenia’s customs legislation contains the following compulsory customs payments levied by the customs bodies:

1. CUSTOMS DUTIES

The customs duty rates are provided by article 102 of the Republic of Armenia Customs Code. Customs duty rates for imported goods are 0% and 10%.

2. CUSTOMS PAYMENT

Besides tariffs, imports are subject to: a customs formalities fee of 3,500 AMD ($9 USD), a customs inspection and recording fee of 1,000 AMD ($3 USD) for each cargo weighing less than one ton, and 300 AMD ($1 USD) for each additional ton of cargo.When customs formalities and/or inspections are carried out elsewhere than in places determined by the Customs Authorities or during non-working days, the customs fees are doubled. Importers also have to pay 1,000 AMD ($3 USD) for each document (form) provided by the Customs Authorities.In addition, importers may incur other customs user fees depending on the services supplied by Customs, such as accompaniment of transit shipment and warehousing services.

3. VALUE ADDED TAX

A 20% VAT is levied on all economic activities, including the importation of goods and services, with the exception of those subject to simplifed taxation (i.e. companies with taxable turnover of less than 58.4 million AMD or $146,000 US) in a calendar year). The taxable base is the customs value of the goods, plus the amount of any import duties and excise tax levied at the time of importation (if any). VAT must be paid within ten days of importation.

4. EXCISE TAX

Excise tax is an indirect tax levied on domestically-produced and imported alcoholic beverages, tobacco products, petrol, and diesel fuels. The tax rate varies according to the product (for more information on customs fees please visit www.customs.am).

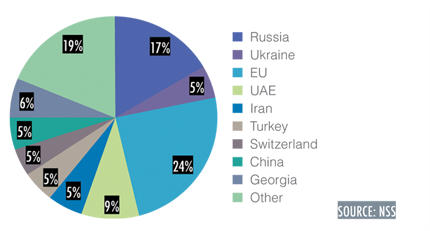

The European Union is the biggest exporter to Armenia. According to 2011 figures, EU countries account for 24% of total imports by Armenia, followed by Russia (17%) and UAE (9%) (See figure 11).

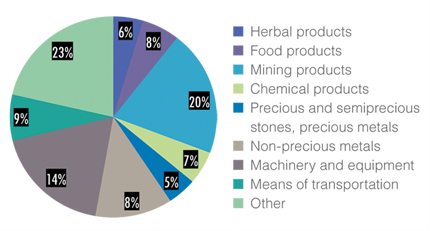

Major imports include mining products, petroleum, oil products, natural gas, machinery and equipment.

EXPORT REGULATIONS

According to the Customs Code of Armenia, all goods exported from Armenia are subject to customs declarations. Goods must be declared at the regional customs offce closest to the exporter's location, with the exception of goods exported via Yerevan International Airport, which must be declared at the airport customs offce. Goods and vehicles with TIR Carnets exported by legal persons are declared in the TIR Customs House in Yerevan. There are no registration requirements for exporters, and all exports of goods from Armenia are subject to a simple customs declaration system. A declaration form is submitted to the customs offcial, who is responsible for verifying its completeness as well as the validity of the supporting documentation.

There are no export restrictions and export taxes in Armenia, and there is no system of minimum export prices. Exported goods and ancillary services are zero rated for VAT purposes.

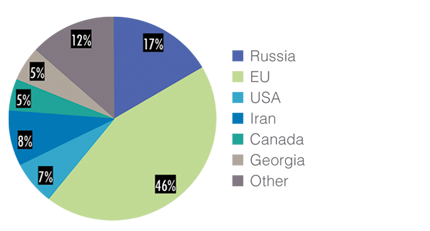

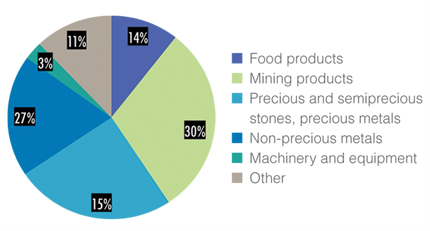

As is the case for most imports, the vast majority of export products are free of any prohibitions or quotas. The export restrictions that do exist are imposed for health, security, and environmental reasons. Armenia has no export licensing regime; however for some products exporters need to obtain prior State permission for export operations. These are weapons, nuclear materials, pharmaceuticals, rare animals and plants, rare objects or artifacts considered part of the national patrimony. Armenia applies only those trade embargoes imposed by United Nations Security Council Resolutions.Export of dual-use goods is regulated by the law “On Controlling Export of Dual-Use Commodities Items, their Transit through the territory of the Republic of Armenia as well as Transfer of Dual-Use Information and Products of Intellectual Activity”. The export of controlled items is done via permission granted by the Ministry of Economy.According to the World Bank's Doing Business Report 2012, in Armenia it takes one day to complete export customs clearance procedures. Only three documents are required. The European Union is the biggest partner for Armenian exports. According to 2011 fgures, the EU accounts for 46% of exports from Armenia, followed by Russia (17%) and the United States (8%) (See fgure 13).Major export items include mining products, precious and semiprecious stones, precious metals, non-precious metals, and food products (see fgure 14).

DOCUMENTATION

The list of documents necessary for customs control:1. For goods and transport facilities imported by organizations and sole proprietor:a) Customs declaration, and in cases specifed in Customs Legislation, CD 1 form of customs value declaration;b) Goods acquisition invoice or contract, or the document proving the request for payment via Internet, or other corresponding substitute document; and c) The document establishing the goods’ transport arrangement (goods-transport consignment note).2. For goods and transport facilities exported by organizations and sole proprietor:a) Customs declaration;b) The invoice or the contract of acquisition, or other corresponding substitute document; andc) The document establishing the goods’ transport arrangement (goods-transport consignment note).3. For goods and transport facilities imported and received in person:a) Customs declaration, and in cases specifed in Customs Legislation, CD 1 form of customs value declaration; andb) Goods acquisition invoice or contract, or the document proving the request for payment via Internet, or other corresponding substitute document.4. For goods and transport facilities exported and sent in person:a) Customs declaration in the cases specifed in Customs Legislation.Other documents can be required by legislation while transporting separate goods by customs frontier; in particular, the original documents required for non-tariff regulation purposes – permission, conclusion, license, certifcate, and certifcation while transporting separate goods by customs frontier by organizations, individual entrepreneurs and physical persons.

CUSTOMS REGIMES

The following customs regimes are defned by Legislation for Implementation of Customs Procedures:

• Import for free circulation

• Re-import

• Transit shipment• Import into Customs warehouse

• Import to duty free shop

• Temporary import for processing

• Temporary import

• Temporary export

• Import into free customs warehouse

• Temporary export for processing

• Export for free circulation

• Re-export

• Renunciation of the ownership right to State benefts

• Import into free economic zoneNon-Armenian nationals may be able to bring personal effects into the country tax-free and duty-free under the temporary importation rules, but this may also involve re-exporting the effects within one year. The authorities will also check off items re-exported against effects brought into Armenia.

CUSTOMS VALUATION

Armenia's regulations on customs valuation are in line with the Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade (GATT) of 1994. The customs value of imported or exported goods is determined by the declarant, or in the absence of required documents by the customs bodies, based on GATT Article VII.The principal method prescribed by the Customs Code of Armenia for the calculation of the customs value of imported goods is based upon the transaction price of the imported goods (the price paid or payable for the goods for export to Armenia). If it is not possible to determine the transaction price of the imported goods, or the customs office has doubts about the data provided by the importer, the following alternate valuation methods will be applied:• Defning customs value by the transaction price of the same goods• Defning customs value by the transaction price of similar goods• Defning customs value of goods transported by the RA customs frontier according to the sale price of the goods in the RA internal market• Defning customs value by the calculation value method• Defning customs value by the reserve method.The Customs Code of Armenia grants the importer the right to demand a written explanation of the valuation decision and the method used by customs authorities, and requires a response within fve working days of submission of the written request. It also gives importers the right to appeal the decision to a superior customs bodies or to the court.

RULES OF ORIGIN

Armenia has introduced a “one-stop shop” process to provide rules of origin certifcates. To receive the certifcate, the proprietor needs to apply to Ekspertiza Limited Liability Company of the Chamber of Commerce and Industry of Armenia. The practice is to apply preferential rules of origin under all free trade agreements that are in force, including those with the following countries: Belarus, Georgia, Kazakhstan, Kyrgyz Republic, Moldova, Russian Federation, Tajikistan, Turkmenistan, and Ukraine.

OTHER PROVISIONS

Imports of plants and plant materials must be accompanied by phytosanitary certifcates from the country of origin. Clearance at the border is only provisional. Imported plant materials must then be taken to an authorized customs clearing site near Yerevan for fnal inspection and sampling before full clearance is given.All imports of animals require veterinary certifcates. This certifcate requires a corresponding certifcate from an offcially recognized veterinarian in the exporting country showing that the animal complies with Armenian requirements for vaccinations and absence of parasites, and comes from an area recognized by the Offce Internationale des Epizooties (OIE) as free of pests and diseases listed in Armenian legislation. Not all imported cargos are subject to sampling and testing.Only 17 products are subject to the Mandatory Conformity Assessment. The list includes fish and fish products, vegetable oils, bread and bakery products, toys, radio equipment, and firearms. Export of the following is prohibited:• Any foreign currency, in cash, exceeding an amount equal to 10,000 USD• Materials containing state secrets• Spirit beverages subject to branding with stamps registered and recognized in Armenia but not bearing such stampsFor more detailed information on Armenian import and export procedures please visit www.customs.am.

GSP and GSP+

GSP and GSP+

The Generalized System of Preferences (GSP) is a preferential tariff system extended by developed countries to developing and emerging-market countries to promote economic growth and enhance their export capabilities. It provides for reduced MFN Tariffs or duty-free entry of eligible products exported by benefciary countries to the markets of preference-granting countries.

The Generalized System of Preferences (GSP) is a preferential tariff system extended by developed countries to developing and emerging-market countries to promote economic growth and enhance their export capabilities. It provides for reduced MFN Tariffs or duty-free entry of eligible products exported by benefciary countries to the markets of preference-granting countries.

Armenia currently enjoys GSP benefciary status with Canada, Japan, Norway, Switzerland, and the United States. Since 2009, Armenia has also been included in the list of countries granted GSP+ by the European Union.

Canada’s GSP product list includes specifc agricultural and industrial goods for which developing countries enjoy a comparative advantage. However, this list excludes several sensitive items, such as certain textiles, footwear, products of the chemical, plastic and allied industries, specialty steels and electron tubes.

Japan grants GSP treatment for selected agricultural and fshery products (337 items) and for selected industrial products (3,141 items). All industrial products are in principle given duty-free treatment, while GSP rates on some sensitive items are 20, 40, 60 or 80% of Most Favored Nation rates.

Norway's tariff duties are zero on an MFN basis for almost all industrial goods. However, tariffs remain, in the range of 5-15% for a few textile products, and there is an exception list for these products in Norway's GSP.

The Swiss GSP covers all industrial goods and many agricultural products, and provides preferential treatment in the form of reduction of, or exemption from, duties. Industrial products are admitted duty-free, with the exception of textiles and clothing, for which preferential reductions of 50% of the normal rate are granted, and a few other products for which specifc preferential reductions are granted.

Products that are eligible for duty-free treatment under the US GSP include most manufactured items; many types of chemicals, minerals and building stone; jewelry; many types of carpets; and certain agricultural and fshery products.

Among the products that are not eligible for GSP duty-free treatment are most textiles and apparel; watches; and most footwear, handbags and luggage products.

Armenia benefted from the EU’s Generalized System of Preferences in 2006-2008, which provided preferential access to the EU market in the form of zero duties on 3,300 products and reduced tariffs for another 3,900 goods.In 2008 the European Commission adopted a resolution which provides Armenia and 15 other countries with special incentives for sustainable development and good governance (GSP+) under the EU GSP Regulation for 2009-2011, which was extended until December 2013. This allows Armenia to export to the EU 7,200 products without any customs duties. In order to keep these enhanced preferences in place over the lifetime of the GSP Regulation, Armenia effectively implements the 27 core international conventions on sustainable development and good governance listed in the Regulation.

Publication

Publication